1. Introduction

Motivation: Find the cost of buying options to prevent arbitrage opportunity.

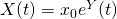

Definition: Let  be the price of a stock at time s, considered on a time horizon

be the price of a stock at time s, considered on a time horizon ![Rendered by QuickLaTeX.com s in [0,t]](http://mytechroad.com/wp-content/ql-cache/quicklatex.com-a762adbae0fb6065ce545731c1dcb638_l3.png) . The following actions are available:

. The following actions are available:

- At any time s,

, you can buy or sell shares of stock for

, you can buy or sell shares of stock for

- At time

, there are N options available. The cost of option

, there are N options available. The cost of option  is

is  per option which allows you to purchase

per option which allows you to purchase  share at time

share at time  for price

for price  .

.

Objective: the goal is to determine  so that no arbitrage opportunity exists.

so that no arbitrage opportunity exists.

Approach: By the arbitrage theorem, this requires finding a probability measure so that each bet has zero expected pay off.

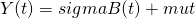

We try the following probability measure on  : suppose that

: suppose that  is geometric Brownian motion. That is,

is geometric Brownian motion. That is,  , where

, where  .

.

2. Analyze Bet 0: Purchase 1 share of stock at time s

Now, we consider a discount factor  . Then, the expected present value of the stock at time t is

. Then, the expected present value of the stock at time t is

Choose ![]() such that

such that ![]()

Then ![]() .

.

Thus the expected present value of the stock at t equals the present value of the stock when it is purchased at time s. That is, the discount rate exactly equals to the expected rate of the stock returns.

3. Analyze Bet i: Purchase 1 share of option i (at time s =0)

First, we drop the subscript i to simplify notation.

Expected present value of the return on this bet is

![]()

= ![]()

Setting this equal to zero implies that![]()

= ![]()

![]() has value 0 when

has value 0 when ![]() , i.e., when

, i.e., when ![]()

Thus the integral becomes![]()

= ![]()

Now, apply a change of variables:![]() , i.e.,

, i.e., ![]()

4. Summary

No arbitrage exists if we find costs and a probability distribution such that expected outcome of every bet is 0.

- If we suppose that the stock price follow geometric Brownian motion and we choose the option costs according to the above formula, then the expected outcome of every bet is 0.

- Note: the stock price does not actually need to follow geometric Brownian motion. We are saying that if stock price follow Brownian motion, then the expected outcome of very bet would be 0, so no arbitrage exists.

A few sanity checks

- When

, cost of option is

, cost of option is

- When

, cost of option is

, cost of option is

- As t increases, c increases

- As k increases, c decreases

- As

increases, c increases

increases, c increases - As

increase, c increase (assuming

increase, c increase (assuming  )

) - As

, c decreases

, c decreases