- Each jump size are

- The time before two jumps are

.

.

1.1 What’s the mean and variance?

Thus,

Let ![]() denote the state of Markov Chain after n jumps, then

denote the state of Markov Chain after n jumps, then![]()

The ![]() denote the continuous Markov Chain after n jumps, then

denote the continuous Markov Chain after n jumps, then![]()

Then we have![]() and

and ![]() .

.

Let ![]() , then

, then![]() .

.

2. Properties of Brownian Motion

- (1)

- (2)

- (3) X(t) has independent increments

i.e., is independent of

is independent of  assuming the intervals of

assuming the intervals of ![Rendered by QuickLaTeX.com [t_1,t_2]](http://mytechroad.com/wp-content/ql-cache/quicklatex.com-2b75109efb608046e3568b2e8579ce71_l3.png) and

and ![Rendered by QuickLaTeX.com [t_3,t_4]](http://mytechroad.com/wp-content/ql-cache/quicklatex.com-e40d919d6ced58cec8bed1c6436689fa_l3.png) are disjoint.

are disjoint. - (4) X(t) has stationary increments

i.e., has the same distribution as

has the same distribution as  if

if  .

.

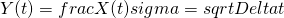

3. Standard Brownian Motion (SBM)

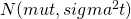

- SBM ~

- Let

, then

, then ![Rendered by QuickLaTeX.com V[Y(t)] = 1](http://mytechroad.com/wp-content/ql-cache/quicklatex.com-b46d4b1bc9a9c3b2fa598be1e1736931_l3.png) .

.

Definition 1: Let ![]() be the standard Brownian motion. Let

be the standard Brownian motion. Let ![]() , then

, then ![]() is Brownian motion with drift

is Brownian motion with drift ![]() .

.

Definition 2: ![]() .

. ![]() is Brownian Motion with drift

is Brownian Motion with drift ![]() and variance parameter

and variance parameter ![]() if

if

has stationary and independent increments

has stationary and independent increments ~

~

Example: Let ![]() be Brownian motion with

be Brownian motion with ![]() and drift

and drift ![]() . What is

. What is ![]() Pr{X(30) >0 | X(10) = -3}

Pr{X(30) >0 | X(10) = -3}![]() Pr{X(30) – X(20) >3 | X(10) =3 }

Pr{X(30) – X(20) >3 | X(10) =3 }![]() Pr{X(30) – X(10) >3 }

Pr{X(30) – X(10) >3 }![]() Pr{X(20) – X(0) >3 }

Pr{X(20) – X(0) >3 }![]() Pr{X(20)>3 }

Pr{X(20)>3 }![]() Pr{N(2,80) > 3} = Pr{X(0,1) > frac{3-2}{sqrt{80}}

Pr{N(2,80) > 3} = Pr{X(0,1) > frac{3-2}{sqrt{80}}![]() 1-Phi(frac{1}{4sqrt{5}})

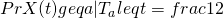

1-Phi(frac{1}{4sqrt{5}}) X(s) = x | X(t) = B

X(s) = x | X(t) = B![]() frac{s}{t} cdot B

frac{s}{t} cdot B![]() frac{s}{t} cdot (t-s)

frac{s}{t} cdot (t-s)![]() s = t/2

s = t/2 X(t)

X(t)![]() N(0, sigma^2 t)

N(0, sigma^2 t)![]() 10 after 6 hours, what is the probability that the stack was above its starting value after 3 hours?

10 after 6 hours, what is the probability that the stack was above its starting value after 3 hours?

Example 2: If a bicycle race between two competitors, Let ![]() denote the amount of time (in seconds) by which the racer that started in the insider position is ahead when 100t percent of the race has been completed, and suppose that

denote the amount of time (in seconds) by which the racer that started in the insider position is ahead when 100t percent of the race has been completed, and suppose that ![]() , can be effectively modeled as a Brownian Motion process with variance parameter

, can be effectively modeled as a Brownian Motion process with variance parameter ![]() .

.

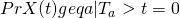

6. First Passage Time

Let ![]() denote the first time that standard Brownian motion hits level a (starting at X(0) = 0), assuming a >0, then we have

denote the first time that standard Brownian motion hits level a (starting at X(0) = 0), assuming a >0, then we have![]()

: you know that at some time before t, the process hits a. From that point forward, you are just as likely to be above a as below a.

: you know that at some time before t, the process hits a. From that point forward, you are just as likely to be above a as below a.  :

:  cannot be above a, because the first passage time to a is after t.

cannot be above a, because the first passage time to a is after t.

Change variables: ![]() , we have

, we have ![]() .

.

By symmetry, we get ![]() .

.